Making Tax Digital might seem like just a buzzword, but with the shift to mandatory digital accounting coming in April 2022 for all VAT-registered businesses, the doors are closing in fast. Now is the time to ensure you’re fully equipped with the right software.

Why the rush? If your business fails to comply within the required time, penalties will be put in place, such as:

- Having a default recorded which is also included when missing a filing.

- Entering a surcharge period for 12 months if you fault again.

- A point system in which we later discuss if further faults occur within the twelve months.

- Lastly to which the points translate into an increased percentage of surcharges for each accumulated default. (Starting from 2% – 15%)

There is still time to get prepared, however, and we’re here to guide you through what you need to know about Making Tax Digital and how to find the right software for your business.

What is Making Tax Digital?

Making Tax Digital (MTD) is a regulation brought in in April 2019 and is a key focus of the Government’s plan to make it easier for businesses – as well as individuals – to keep track of their affairs and taxes.

Currently, the regulation states that all VAT-registered businesses who have a turnover of £85,000 or more are required to keep all VAT and business records digitally and by law have to submit their tax returns via a software which is MTD compliant.

However, changes are coming. As of April 2022, all VAT-registered businesses, regardless of their turnover, will be required to follow the same rules under MTD for their first return. That’s why any VAT-registered business needs to get ahead and choose the right MTD compliant software before this date.

The Importance of Choosing the Right Software

There is a whole host of accountancy software to choose from, each which provides different features. Aside from the cost implication of choosing the wrong one, choosing the right software is vital when trying to get your head around a new process like this.

When exploring, you need to properly assess and evaluate the software to understand which meets your business needs and still meets the MTD requirements.

HMRC won’t allow for just any software to be used, so it’s better to find out as soon as possible whether the software you’re considering is MTD Compliant.

Here are the compliance regulations the software needs to meet in order to meet MTD regulations:

- The software needs to be able to record your business’ details and all your VAT-related transactions for up to six years.

- The software also needs to include the date and additional information regarding any VAT paid or withheld for each transaction.

- It also needs to calculate what VAT you owe based on your incomings and outgoings.

- Lastly the software needs to be able to submit your VAT return directly to HMRC via an API also known as an application programming interface.

HMRC has also created a list of MTD compliant software which is worth a read.

Key factors to consider when evaluating MTD software

Flexibility & Adaptability

Both factors are vital when it comes to the software you choose for your business as it can affect how your business functions.

You should always consider how the product can adapt to your business and how it meets the needs of your businesses tax requirements both now and in the future.

Consider also any global transactions and whether the software would meet international criteria. Rules surrounding this change from time to time and you need software which can quickly adapt.

Implementation Speed

As the deadline is creeping up, you need to be looking at what the turnaround time for implementation is. How quickly can your solution to MTD be deployed and integrated within your current business infrastructure?

Many businesses tend to have their own unique process already in place and when looking into new software you’ll need to make sure that the software vendor you are going with has the expertise to ensure the transition goes smoothly.

User Experience

Choosing a software that is easy to grasp and navigate shouldn’t become a major barrier for your business. That’s why when it comes to choosing any software for your business, always question if the software is easy enough for not only you to understand but also the employees that will be utilising it.

A good way to look into the user experience of software is to see how customisable it is to your business and how well it can integrate into the existing software you use.

With tax technology the main idea is to simplify your role as much as possible whilst still meeting legislative requirements. Due to the pandemic many of us still work from home or have a hybrid work style which means that the software should be able to offer the same experience and functionality from home as it does from the office. This is where cloud technology and its security come into play.

Maintenance

When dealing with software there are always small bugs or issues that may appear at some point later down the line, and so before committing to any software you should always look and assess at how much IT support it will require during and after the implementation.

In order to do this effectively, it’s best that you inform your IT department and ask for their guidance on software which doesn’t require a mass amount of work or money to maintain.

Support

With software vendors, support is vital. If there is lack of support or no support provided, it could potentially cost your business a substantial amount of time and money if anything was to go wrong.

In order to get the best support, especially when dealing with tax software, it’s best to audit the vendor. Due to the complexity of tax it’s good to see if their team is a balance of software engineers and tax experts. If their employees are mainly all software engineers, do they work in partnership with tax experts to provide the support needed for your business? The better support the vendor has the better it is for your business in the long run.

Does KashFlow fit your MTD needs?

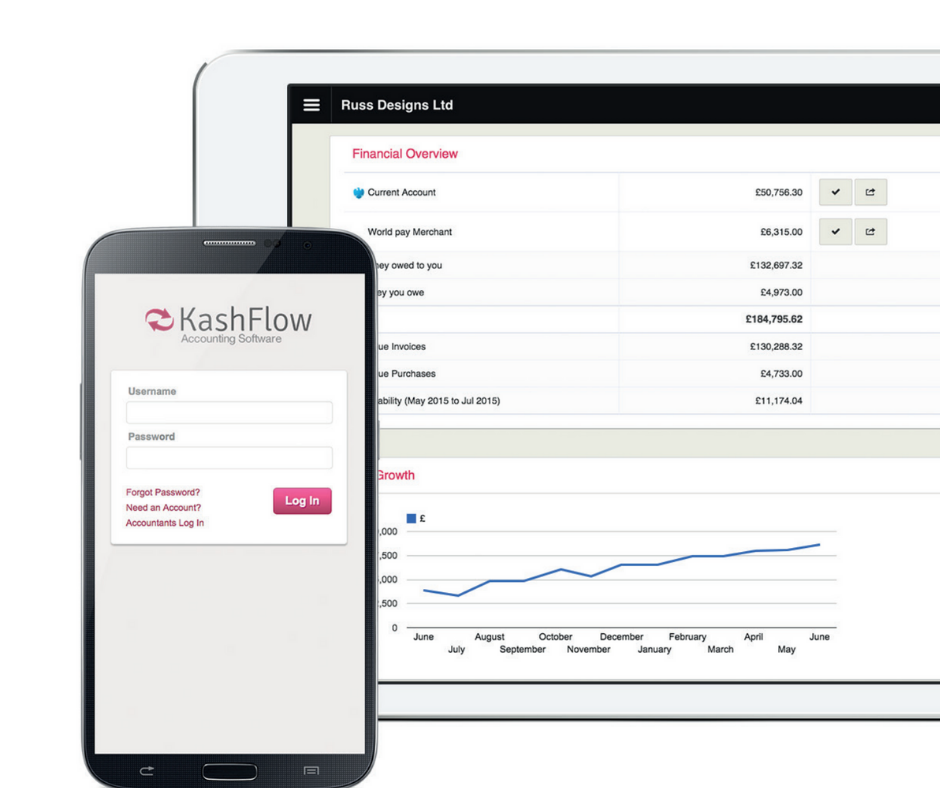

If you are in the current process of looking for a fast, efficient and reliable solution for Making Tax Digital then why not check out our software KashFlow.

KashFlow is a Making Tax Digital compliant accounting software that is designed for small businesses and is developed here in the UK.

Its simple layout makes it easier for your employees to use, saves time and reduces training costs, thus allowing your accounting to run as smoothly and efficiently as possible.

From generating VAT returns quickly to generating email invoices, it provides the flexibility many businesses need. It even has a mobile app for iOS and Android for on-the-go management.

Speak to us at hello@shenward.com for more information.